Sample Economic Models

You are here: /announcements/sample-economic-models/2025-03-06

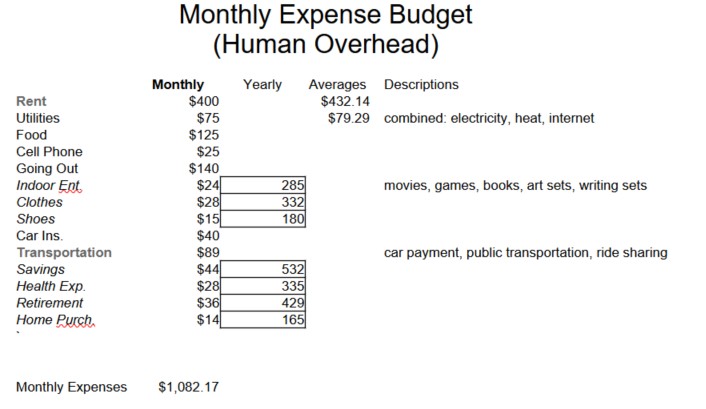

Because the United States lacks national modeling, the personal budget and 1st amendment grievances are imperative to achieving financial stability within the US. This is what a teenager budget looks like considering their parents might be charging them rent in preparation for their own place, vehicle, and life sustaining job.

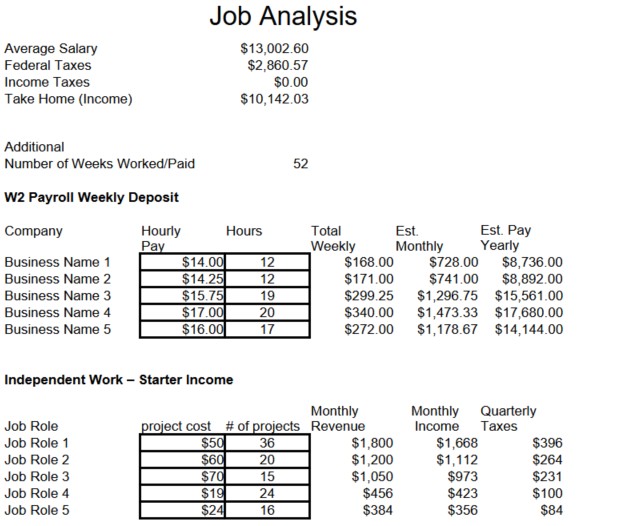

Once a budget has been put in place to establish financial requirements, to live outside the parents home, the next step is finding a job, and evaluating how that fits in with income requirements.

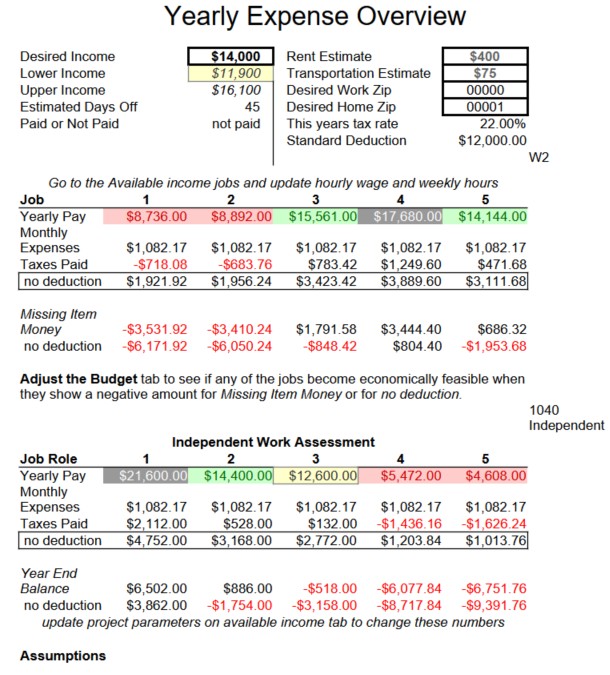

Finally, its important to view the yearly household accounting data. A teenager living on their own, can most recently be considered independent, and there are proposals to allow them to file taxes as head of household if they pay rent to their parents or care takers.

Yearly pay correlates to the numbers at the top of the budget sheet. Green is most likely yes, red is likely not, yellow is maybe but low income.

With yellow, the taxes are important. If there is no missing money or the year end balance is not red, then the personal budget is met for the whole year with, the standard deduction.

If those two rows are red then that means that either taxes will be short or the budget will not be met. So those are usually no jobs.

The no deduction row shows the amount needed to stop claiming the standard deduction, this is usually a first step financial goal for adults and teenagers after paying off debt. If its red, money is needed to stop claiming a standard deduction, if its black that means money is available beyond the budget even without the standard deduction.

This is where most adults start life in the US regardless of age past 18 years old.

Most adults aren't on welfare, only 12-15 million people out of 330 million are on welfare in the US. Its not difficult to get off if there are jobs, good policy makers, and the person has good budgeting skills and looks forward to positive lifestyle.

The average rent for good earners is around 12% to 25% of take home income because, they are usually saving for retirement which is often around 50 now; and they are usually looking to buy a home, which are projected to come down in costs or have shorter purchasing periods, closer to 10-15 years.

The grey jobs on the budgeting sheet provide more money than is required, it may need additional tools, training, or more hours than are available to spend at work.

Economic modeling starts from here, on a regional or national level, all these numbers are put into databases to ensure people are meeting SDGs and have good economic stability. Regional or national modelers don't normally look at everyone's data; they take samples of data that are representative of large groups of people. This is then combined with grievances, requests, and observations to make adjustments.

Constitutional Tax References

Taxes will be Proportionate

https://constitution.congress.gov/browse/article-1/section-9/clause-4/

Taxes will be Uniform

https://constitution.congress.gov/browse/article-1/section-8/clause-1/

This indicates taxes will be a consistent percentage throughout the US. Once the standard deduction is wound down, with people under 50, or any age, then on the budget sheet, red areas without the standard deduction will be grants that require budget assessment and policy planning.

This invalidates the 16th amendment due to the supremacy clause.

U.S. Const. art 6 Cl 2

https://constitution.congress.gov/browse/article-6/clause-2/

U.S. Const. amend 16

https://constitution.congress.gov/browse/amendment-16/

All Rights Reserved. Copyright © 2019-2025.